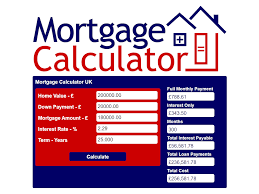

How to Use a Mortgage Calculator to Estimate Your Loan Costs in the UK

Choosing a property is the most significant economic judgements most people make, in addition to making certain are able to afford the particular mortgage is extremely important for you to the prosperity of your own investment. Just about the most highly effective methods open to homebuyers while in the UK is a mortgage calculator. This tool will help you better view the monetary dedication linked to your possessions purchase. Here are a few essential advantages of choosing any Mortgage Calculator UK when setting up the next house purchase.

1. Quick and Appropriate Fiscal Analysis

Your mortgage calculator enables you to input numerous guidelines, for instance loan amount, mortgage rates, along with loan phrase, to obtain an immediate and correct estimate of the regular payments. This saves serious amounts of assures that you’re well-informed just before investing any mortgage agreement.

2. Allows Established some sort of Reasonable Finances

Through a mortgage calculator , it is simple to decide what you could afford. This instrument can help you evaluate how much you’ll want to acquire and also just what exactly your current repayments will be like. That quality enables you to established a practical spending budget and get away from overstretching ones finances.

3. Know the Impact involving Awareness Charges

Rates of interest participate in an important role around the total cost of your respective mortgage. Mortgage calculators help you picture the issue of countless interest rates on the monthly obligations in addition to full repayment more than time. This lets you produce smart conclusions pertaining to preset or perhaps diverse rates, encouraging you will find the best option in your situation.

4. Evaluate Various Mortgage Possibilities

Mortgage Calculator UK usually let you to realize different personal loan terminology and check wavelengths, delivering to be able to evaluate different options. No matter if you prefer the shorter-term bank loan regarding quicker payment or possibly a longer term to scale back month to month expenses, the actual calculator makes it possible to pick a qualified fit.

In summary, having a mortgage calculator plays the main step up safe-guarding your mortgage for your UK home purchase. It may help you make advised conclusions, system your capacity to pay, and select the right mortgage solution, in the long run establishing anyone upwards pertaining to a booming in addition to economically ecological homeownership experience.