Tide Bank App Review: In-Depth Look at How You Can Manage Your Business Account

The tide is still rising for Tide bank customers. With a full slate of mobile banking options including iPhone and Android apps, more consumers understand that this New York lender supports their customers’ mobile lifestyles. Today, many people rely heavily on their mobile devices to connect with the rest of the world. As the mobile industry grows, banks must evolve their processes and structures to respond with a competitive mobile environment. The innovative technologies are making it easier than ever to stay connected to your bank, while on the go.

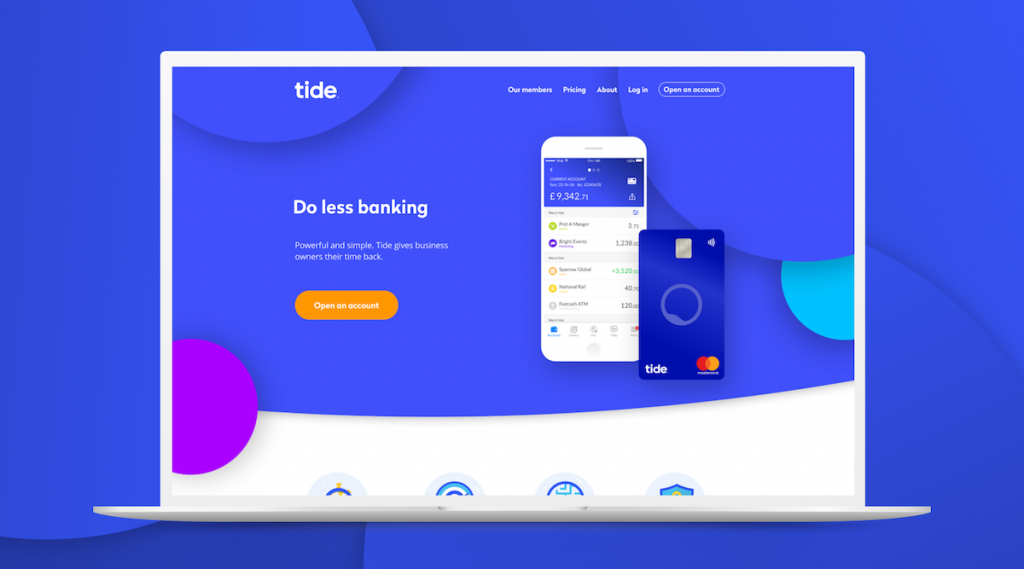

With several innovative features on its mobile banking app, Tide bank has made it easier than ever to conduct all of your business transactions from the comfort of your home or office. The easy to use apps provide you with a visual representation of all of your banking transactions, allowing you to review all information for the month. You can even set up automatic payments for your purchases using Tide’s in-built payment system. If you need to do manual work, you can easily export all of your information to your desktop, laptop or iPad. When you’re done, you can simply sign out of the account and close the app, or open it again to manage your account. It’s all automated and convenient, ensuring that you always stay on top of your finances.

With Tide’s Sole Trader program, customers have the opportunity to open one account and maintain two separate business bank accounts. This allows you to manage both accounts on a single screen, providing you with a streamlined method for monitoring and interacting with both accounts. If you’re a sole trader, you can set up deposit limits and transaction fees, as well as set up automatic deposits and debits for Tide’s other clients. All transactions are managed automatically, giving you more control than ever over how your money is being spent.

If you currently have two Tide bank accounts and wish to combine them into one convenient multi-account solution, you can do so with the help of the Tide business bank review program. Using this software, you can quickly determine which business account is right for you. If you’re looking for an easy way to move funds between accounts while maintaining a level of privacy, this option is for you. For those who need more privacy but still want to be able to keep an eye on their accounts, this option is ideal.

If you’re a business owner that needs to manage multiple accounts in a hurry, you’ll appreciate the speed at which you can log into your bank from anywhere. You can even check an in-depth history of your transactions from any location, providing you with the peace of mind to know that your transactions have been made in a timely manner. If you need to see exactly how much money has changed since you last checked on your balance, the Tide mobile app provides visual proof. No matter where you are, you can review your bank statements and balance in a few short hours from anywhere.

If you’re curious about how Tide’s award-winning print ads have been doing recently, you can check out the latest campaign from the company. The “We All Go Green” campaign features eco-friendly print ads that highlight the company’s efforts to go green, reduce waste, and improve customer service. This print campaign shows off Tide’s commitment to making its products better for the planet. Check out the latest in-app offers and see how the company continues to lead the industry.